May 15, 2023

𝗟𝗮𝘄 𝗖𝗵𝗮𝗻𝗴𝗲 𝗣𝗿𝗲𝘀𝘀 𝗥𝗲𝗹𝗲𝗮𝘀𝗲: (Effects Homestead and Military Tax Credits) On May 4, 2023, Governor Reynolds signed House File 718, establishing a homestead tax exemption for claimants 65 years of age or older. In addition to the homestead tax credit, eligible claimants who own the home they live in and are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax exemption. For the assessment year beginning on January 1, 2023, the exemption is for $3,250 of taxable value. For assessment years beginning on or after January 1, 2024, the exemption is for $6,500 of taxable value. An exemption is a reduction in the taxable value of the property rather than a direct reduction in the amount of property tax you pay. The Iowa Department of Revenue has amended the Homestead Tax Credit and Exemption (54-028) form to allow claimants to apply for the new exemption. Applications are due July 1st to your local assessor. If the exemption is granted, the exemption will be allowed for future years without future filing as long as the claimant continues to qualify.

The Military Tax Exemption, previously was an annual credit amount of $1,852.00 has been increased to a $4,000.00 annual credit. Military Veterans currently receiving this credit DO NOT need to take any action; the new amount will be automatically applied.

Veterans: If you haven’t signed up for this credit in the past, please first take your DD-214 to the Recorder’s Office and get it recorded before filing out the form in the Assessor’s Office.

Again, these are two different credit increases and only the Homestead Credit requires action if you are 65 or older; the Military Tax Exemption will be automatic if your already signed up.

**IMPORTANT: you MUST complete an application to receive this exemption, even if you already have an application for the homestead credit on file.

That form does not provide a date of birth, and that information is required Application forms can be found at this link or by contacting the Benton County Assessor’s Office:

111 E 4th St., Vinton, IA 52349

or by phone at 319-472-5211

*Please Note, this must be done prior to July 1, 2023 for the credit to be applied to next fiscal year.

April 19, 2024

March 4, 2024

April 15, 2024

Benton County Veterans Affairs is looking for volunteer drivers to assist our Veterans in getting to and from their appointments.

April 2, 2024

🗞PRESS RELEASE: Local business donates to Wildcat Bluff Expansion! 🥳Gwen and Don Eells have donated to the expansion project! Check out what they have to say in the press release 👀 📌Please note! We still do not own the acquisition site and it remains private until we raise the rest of these funds. 🧐Be sure to take advantage of doubling your impact now with the Myers' Family Conservation Fund. Remember, your donations are tax deductible. Paypal: https://www.paypal.com/donate/?hosted_button_id=MQ2BRVT9G5Q8Y https://www.bentoncountyia.gov/conservation/donate/ https://www.bentoncountyia.gov/news/ Reach out for information! #DifferenceMaker #explorewithbccb #thisisiowa #iowa #conservation #bentoncounty #donationsMarch 28, 2024

Below is information from the Department of Management on the recent Tax Levy mailing about House File 718.March 1, 2024

Notice from the Benton County Auditor’s Office:February 15, 2024

January 30, 2024

🗞PRESS RELEASE: Local business donates to Wildcat Bluff Expansion! 🥳Local business, Frontier Co-op, has donated to the expansion project! Check out what they have to say in the press release 👀 📌Please note! We still do not own the acquisition site and it remains private until we raise the rest of these funds. 🧐Be sure to take advantage of doubling your impact now with the Myers' Family Conservation Fund. Remember, your donations are tax deductible. Paypal: https://www.paypal.com/donate/?hosted_button_id=MQ2BRVT9G5Q8Y https://www.bentoncountyia.gov/conservation/donate/ https://www.bentoncountyia.gov/news/ Reach out for information! #DifferenceMaker #explorewithbccb #thisisiowa #iowa #conservation #bentoncounty #donations

January 22, 2024

🗞PRESS RELEASE: We're excited to announce additional support towards Wildcat Bluff Addition Project! 🥳A supporter donated a substantial amount AGAIN, to take advantage of the Myers' Family Conservation Fund Challenge grant. John Beerbower challenges you to join him in doubling your impact! 📌Please note! We still do not own the acquisition site and it remains private until we raise the rest of these funds. Thanks to generous individuals such as the John Beerbower we continue to get that much closer. 🧐Reach out for information on your tax deductible donation!

January 9, 2024

🗞PRESS RELEASE: We're excited to announce a substantial donor towards Wildcat Bluff Addition Project and a chance to double your money! 🥳A local donor recently came forward with a substantial donation towards the Wildcat Bluff Acquisition to more than double the size of the existing park. Not only that, they have offered to match any donations up to $100,000! This allows the opportunity for you, your business, or your organization to double your impact! 📌Please note! We still do not own the acquisition site and it remains private until we raise the rest of these funds. Thanks to generous individuals such as the Myers' Family Conservation Fund we are getting that much closer. 🧐Reach out for information on your tax deductible donation!January 8, 2024

January 8, 2024

November 28, 2023

September 18, 2023

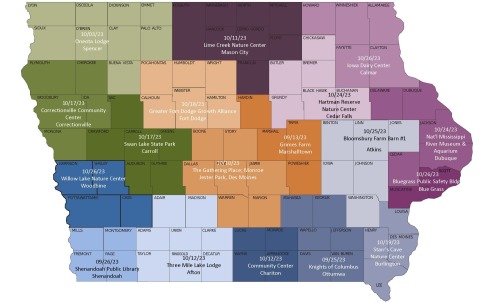

Are you interested in improving natural resources such as water, air, habitat and wildlife for the direct benefit of Benton County? Please join us on Wednesday, October 25th from 1-3pm at Bloomsbury Farm (Party Barn #1) to share ideas for how Iowa’s premier funding program for outdoor recreation and conservation can assist your county and communities.April 25, 2023

The Benton County Conservation Board (BCCB) is excited to announce an opportunity to expand one of its existing properties.April 3, 2023

KWWL news story on property assessments show increases in iowa home valuesFebruary 16, 2023

February 2, 2023

September 22, 2022

September 22, 2022

August 4, 2022

June 13, 2022

March 24, 2022

March 10, 2022

Benton County Redistricting Committee-Election Precinct Changes Public HearingFebruary 3, 2022

Housing Trends - Solar is hot in today's marketFebruary 1, 2022

February 1, 2022

October 13, 2021

2021 Election Law Changes per House File 413July 29, 2021

2021 Election Law Changes for Iowa VotersJuly 29, 2021

July 29, 2021

July 6, 2020

May 22, 2020

April 20, 2020

March 26, 2020

Here is a list of Federal/State Candidates for the Primary Election on June 2, 2020.March 26, 2020

Here is the complete list of who has filed for the upcoming Primary Election in Benton County.March 17, 2020

March 16, 2020

October 25, 2019

Deadline for City/School ElectionOctober 8, 2019

Absentee Voting Ballots Ready for City/School ElectionSeptember 23, 2019

View the list of candidates who have filed papers to place their names on the November 5, 2019, City/School election ballot.August 29, 2019

Benton County voters will soon have a user-friendly website to find all of their election information.August 29, 2019

New Voter ID laws have taken effect for 2019. Make sure you know what you can expect when heading to the polls.August 26, 2019

Nomination Process for Combined City/School Election Begins August 26.August 21, 2019

PUBLIC NOTICE is given that a Special School Election of the Vinton-Shellsburg Community School District will be held on Tuesday, September 10, 2019.