April 1, 2023

In the past three years, we have seen more changes due to derecho damage, and the limited housing available, than any other county. We had a reappraisal project in 2021 that was based on 2020 sales with adjustments on the derecho-damaged properties. The rapidly rising land values, increased building supply costs and limited labor for rebuilding, has also affected our market. Although our paths may be different, all the markets in Iowa have increased a great deal. The residential market in 2022 rose at the most rapid rate to the highest levels in history. If the sales decrease, the assessments will decrease which they did in the late 1980s.

The future taxes on these assessments (which cannot be determined now), will be based on the local taxing authorities’ budgets divided by taxable value (the assessment x assessment limitation factor).

In Iowa the assessed values, in every odd year, are adjusted by the sales of the previous year for residential and commercial classes. If the assessor does not adjust to the median value of the prior year sales, plus or minus 5%, the Iowa Department of Revenue will adjust the assessed values to 100% in an equalization order in the fall of that year. The agricultural values are based on a five-year income basis stated per Iowa Code.

Agricultural: Increased approximately 28% for land and 20% for buildings. These numbers are likely less than the state average for agricultural.

Non-Agricultural land: These values typically went up about 25% based on vacant land sales throughout the county.

Urban Residential: Each town was adjusted based on their prior sales ratios; increases of +25 to +30% were common based on their sales. These numbers are higher than the state average, but certainly not the highest, some being as much as 45% on average.

Rural Residential: These properties show the highest increases in Benton County of +30 to 40% based on sales. Assessments were adjusted based on area (townships). These numbers while higher than state average, are certainly not the highest, with some counties raising theirs on average, as much as +46%.

Multi-Residential: These properties were adjusted based on their town and building type +25% based on sales. Our county numbers are slightly higher than average, with some counties increasing values as much as +60%.

Commercial: All declarations of values are verified for commercial sales, due to the impact only a few sales can have to a revaluation. The 2022 sales and appraisals by the Iowa Department of Revenue indicated a +30% adjustment. Assessments were revalued based on each town and types of properties sold. This was higher than most in the state, but some increased as high as +47.5%. Our commercial properties did not have a revaluation in 2021, because of their prior year sales data, so this year’s revaluation was based on a four-year period.

Industrial: Industrial properties were similar to Commercial; this property class was not revalued in 2021. The revaluation was also over a four-year span and saw an increase of about 15%.

Other jurisdictions may have revalued last year based on their prior sales and are also revaluing this year, which will reflect in a smaller increase for 2023. Our values reflect the change of the median sales from 2020 to the sales in 2022, which are used for revaluation.

Assessment limitation: In 1978 the assessment limitation or rollback factor, was created to help stabilize taxable values due to inflation, each year, based upon the allowable growth per class statewide. Iowa limits statewide growth on taxable value for residential properties to 3% at the state level; not county, city or individual property. The end result is the taxable value increases across the state, increases at a stable rate.

Property owners are encouraged to do further research on their properties’ current market value by visiting www.beacon.schneidercorp.com and clicking on property search under Benton County, Iowa for comparable sales data. A sales list can be found on our county website at bentoncountyia.gov/assessor.

If you are not satisfied that the foregoing assessments is correct, you may contact the Assessor on or after April 2, to and including April 25, of the year of the assessment to request an informal review of the assessment pursuant to section 441.30. If you are not satisfied that the foregoing assessment is correct, you may file a protest against such assessment with the Board of Review on or after April 2, to and including May 1 of the year of assessment.

A valid appeal to the Assessor or the Board of Review should not be based solely on the increase of your assessment value or the possible taxes you may pay. It should be based on the current market value or a comparison to other properties assessments.

Reminder, the assessed value only reflects the current market value. The assessor does not determine tax rates, calculate or collect taxes.

The 2023 assessed value will be used to calculate property taxes which will be payable in the fall of 2024 and in the spring of 2025.

If you have further questions or concerns regarding your 2023 assessed value, please call the office. Our office hours are 8:00 AM to 4:30 PM Monday through Friday information about your rights to contest your assessed value along with dates to file protest can be found on the included assessment notification.

April 30, 2025

February 17, 2025

February 5, 2025

February 5, 2025

April 19, 2024

March 4, 2024

June 20, 2025

🚶♀️🌞 New Sidewalk at Hannen Lake Beach! 🌞🚶♂️ We’re thrilled to announce that an accessible sidewalk has been installed at the Hannen Lake Park beach! This project is a big step toward making our parks more inclusive and enjoyable for everyone.June 6, 2025

We’re excited to welcome you back to the Atkins Roundhouse Area. While the space is still a work in progress, it’s ready for you to enjoy once again.

March 7, 2025

Join us for the Wildcat Bluff Recreation Area Addition Grand Opening on Saturday, March 29th from 1-3pm.

March 5, 2025

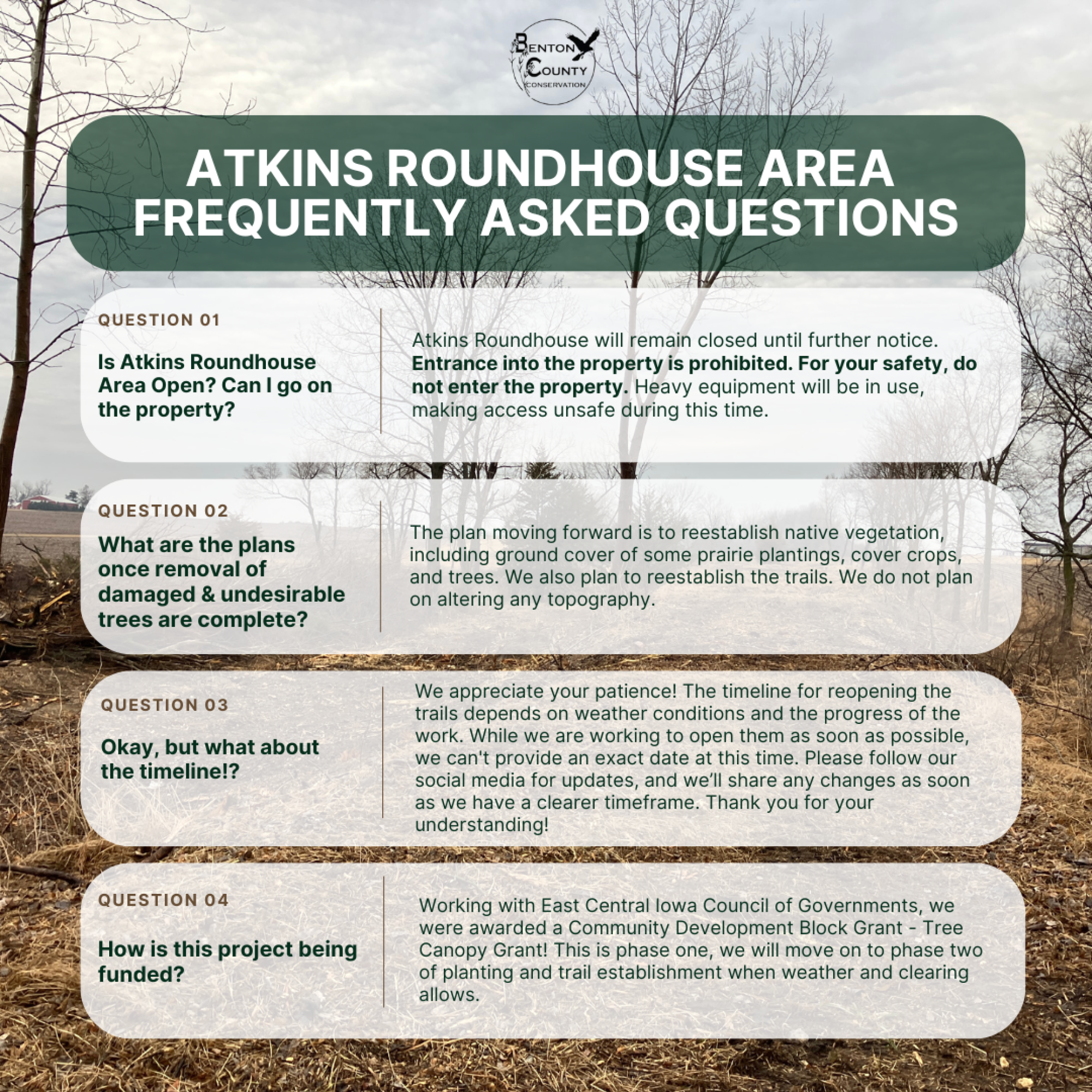

Questions about the Atkins Roundhouse Area project? Check out frequently asked questions here!December 16, 2024

A public funding campaign from local citizens, organizations and businesses raised $600,000 for Benton County Conservation Board. These funds will go toward adding an additional land adjacent to the Wildcat Bluff Recreation Area. The addition more than doubles the size of this popular park, providing even more outdoor recreation opportunities in the county and protecting sensitive Cedar River floodplain. The new addition is closed to the public as the transfer of land is processed, but there is an anticipated event to celebrate the opening this spring.

April 15, 2024

Benton County Veterans Affairs is looking for volunteer drivers to assist our Veterans in getting to and from their appointments.

April 2, 2024

🗞PRESS RELEASE: Local business donates to Wildcat Bluff Expansion! 🥳Gwen and Don Eells have donated to the expansion project! Check out what they have to say in the press release 👀 📌Please note! We still do not own the acquisition site and it remains private until we raise the rest of these funds. 🧐Be sure to take advantage of doubling your impact now with the Myers' Family Conservation Fund. Remember, your donations are tax deductible. Paypal: https://www.paypal.com/donate/?hosted_button_id=MQ2BRVT9G5Q8Y https://www.bentoncountyia.gov/conservation/donate/ https://www.bentoncountyia.gov/news/ Reach out for information! #DifferenceMaker #explorewithbccb #thisisiowa #iowa #conservation #bentoncounty #donationsMarch 28, 2024

Below is information from the Department of Management on the recent Tax Levy mailing about House File 718.March 1, 2024

Notice from the Benton County Auditor’s Office:February 15, 2024

January 30, 2024

🗞PRESS RELEASE: Local business donates to Wildcat Bluff Expansion! 🥳Local business, Frontier Co-op, has donated to the expansion project! Check out what they have to say in the press release 👀 📌Please note! We still do not own the acquisition site and it remains private until we raise the rest of these funds. 🧐Be sure to take advantage of doubling your impact now with the Myers' Family Conservation Fund. Remember, your donations are tax deductible. Paypal: https://www.paypal.com/donate/?hosted_button_id=MQ2BRVT9G5Q8Y https://www.bentoncountyia.gov/conservation/donate/ https://www.bentoncountyia.gov/news/ Reach out for information! #DifferenceMaker #explorewithbccb #thisisiowa #iowa #conservation #bentoncounty #donations

January 22, 2024

🗞PRESS RELEASE: We're excited to announce additional support towards Wildcat Bluff Addition Project! 🥳A supporter donated a substantial amount AGAIN, to take advantage of the Myers' Family Conservation Fund Challenge grant. John Beerbower challenges you to join him in doubling your impact! 📌Please note! We still do not own the acquisition site and it remains private until we raise the rest of these funds. Thanks to generous individuals such as the John Beerbower we continue to get that much closer. 🧐Reach out for information on your tax deductible donation!

January 9, 2024

🗞PRESS RELEASE: We're excited to announce a substantial donor towards Wildcat Bluff Addition Project and a chance to double your money! 🥳A local donor recently came forward with a substantial donation towards the Wildcat Bluff Acquisition to more than double the size of the existing park. Not only that, they have offered to match any donations up to $100,000! This allows the opportunity for you, your business, or your organization to double your impact! 📌Please note! We still do not own the acquisition site and it remains private until we raise the rest of these funds. Thanks to generous individuals such as the Myers' Family Conservation Fund we are getting that much closer. 🧐Reach out for information on your tax deductible donation!January 8, 2024

January 8, 2024

November 28, 2023

September 18, 2023

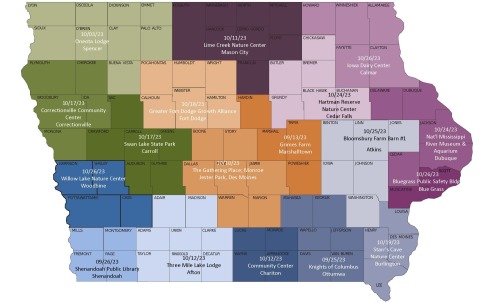

Are you interested in improving natural resources such as water, air, habitat and wildlife for the direct benefit of Benton County? Please join us on Wednesday, October 25th from 1-3pm at Bloomsbury Farm (Party Barn #1) to share ideas for how Iowa’s premier funding program for outdoor recreation and conservation can assist your county and communities.April 25, 2023

The Benton County Conservation Board (BCCB) is excited to announce an opportunity to expand one of its existing properties.April 3, 2023

KWWL news story on property assessments show increases in iowa home valuesFebruary 2, 2023

September 22, 2022

September 22, 2022

August 4, 2022

June 13, 2022

March 24, 2022

March 10, 2022

Benton County Redistricting Committee-Election Precinct Changes Public HearingFebruary 1, 2022

February 1, 2022

October 13, 2021

2021 Election Law Changes per House File 413July 29, 2021

2021 Election Law Changes for Iowa VotersJuly 29, 2021

July 29, 2021

July 6, 2020

May 22, 2020

April 20, 2020

March 26, 2020

Here is a list of Federal/State Candidates for the Primary Election on June 2, 2020.March 26, 2020

Here is the complete list of who has filed for the upcoming Primary Election in Benton County.March 17, 2020

March 16, 2020

October 25, 2019

Deadline for City/School ElectionOctober 8, 2019

Absentee Voting Ballots Ready for City/School ElectionSeptember 23, 2019

View the list of candidates who have filed papers to place their names on the November 5, 2019, City/School election ballot.August 29, 2019

Benton County voters will soon have a user-friendly website to find all of their election information.August 29, 2019

New Voter ID laws have taken effect for 2019. Make sure you know what you can expect when heading to the polls.August 26, 2019

Nomination Process for Combined City/School Election Begins August 26.August 21, 2019

PUBLIC NOTICE is given that a Special School Election of the Vinton-Shellsburg Community School District will be held on Tuesday, September 10, 2019.